Are you a parent who has dismissed RESPs (registered education savings plans) for your children's postsecondary savings because the contribution maximum is limited to $50 000 and university costs could easily surpass the contribution maximum? If so, you should give RESPs another chance, since you could get much more out of them than you put in—due to compound growth and available government grants.

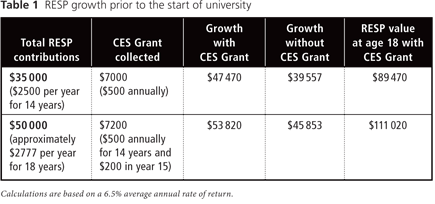

When your RESP contributions are given sufficient time to benefit from the effects of compound growth, your RESP beneficiary could receive more than twice the amount of money than you contribute to the RESP. Table 1 shows that an RESP could grow to $89 470 when the child reaches age 18, if the parent contributes a total of $35 000 ($2500 per year over 14 years). If that parent contributes $50 000 (approximately $2777 per year over 18 years), the RESP could grow to $111 020. The calculations assume an average annual rate of return of 6.5%.

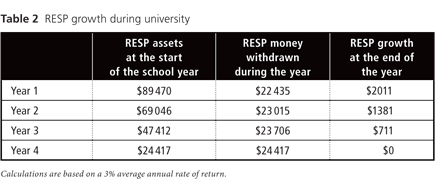

One of the available government grants for RESPs is the Canada Education Savings Grant (CES Grant). It's a top-up grant which provides up to $500 annually for each eligible RESP beneficiary, up to a lifetime maximum of $7200 per beneficiary. With compound growth, that grant money could also double, so you shouldn't neglect to collect the grant for your child's RESP. Plus, growth within the RESP can continue even after the student starts to take money out of the plan to fund his or her university expenses (Table 2).

Say your child takes out approximately one-quarter of the RESP amount each year to cover his or her postsecondary expenses. During those four years that your child is in university, the RESP could easily grow by another $4100, assuming an average annual return of 3%. Depending on the program in which your child is enrolled, that $4100 could be enough money to pay for a year's tuition.

The lower rate of return of 3% was used for the RESP growth calculations during school, since it is generally recommended that investments remaining in the plan should be switched to more conservative choices when the child is ready to begin postsecondary schooling. For example, you may want to consider switching the RESP assets to income investments such as conservative bond funds. Meanwhile, if there are 10 years or more remaining before the RESP money is needed, higher risk but historically higher returning equity investments can be selected, as there will be more time to ride out any downturns in the market. Always consult your advisor to ensure your asset selection is appropriate for your risk tolerance.

Here are two other reasons to consider RESPs. The 2011 federal budget made RESPs even more attractive by providing the same RESP withdrawal privileges to students studying abroad that are given to students enrolled in Canadian universities. As well, the 2011 budget made it possible to transfer between individual plan RESPs for siblings without tax penalties and without triggering the repayment of the CES Grant. Family plan RESPs for siblings already have these advantages.

To learn more about setting up an RESP that grows with your child, contact a certified financial planner at CDSPI Advisory Services Inc. at 1-877-293-9455, ext. 5023. You'll receive personalized no-cost assistance with your education savings and other investment goals. (Restrictions may apply to advisory services in certain jurisdictions.)